Hsmb Advisory Llc Fundamentals Explained

Hsmb Advisory Llc Fundamentals Explained

Blog Article

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

Table of ContentsFacts About Hsmb Advisory Llc UncoveredThe Main Principles Of Hsmb Advisory Llc Not known Details About Hsmb Advisory Llc What Does Hsmb Advisory Llc Mean?An Unbiased View of Hsmb Advisory Llc5 Easy Facts About Hsmb Advisory Llc ExplainedSee This Report about Hsmb Advisory Llc

You should receive a certificate of insurance coverage explaining the arrangements of the group policy and any type of insurance coverage fee. Normally the optimum amount of protection is $220,000 for a mortgage finance and $55,000 for all various other financial obligations - https://www.indiegogo.com/individuals/37505142. Credit scores life insurance need not be acquired from the company giving the loan

Little Known Questions About Hsmb Advisory Llc.

For the most part, however, home collections are not made and costs are sent by mail by you to the agent or to the firm. There are specific variables that have a tendency to increase the expenses of debit insurance policy more than normal life insurance policy strategies: Certain costs are the very same whatever the dimension of the plan, to ensure that smaller sized policies provided as debit insurance policy will have higher costs per $1,000 of insurance policy than larger size routine insurance coverage.

Considering that very early gaps are expensive to a business, the prices must be passed on to all debit insurance policy holders. Given that debit insurance is created to consist of home collections, greater commissions and fees are paid on debit insurance coverage than on routine insurance. In numerous situations these higher costs are passed on to the insurance holder.

4 Easy Facts About Hsmb Advisory Llc Shown

Where a firm has various costs for debit and regular insurance it may be feasible for you to acquire a bigger quantity of routine insurance coverage than debit at no extra cost. If you are assuming of debit insurance coverage, you ought to certainly explore normal life insurance coverage as a cost-saving alternative.

The Ultimate Guide To Hsmb Advisory Llc

Joint Life and Survivor Insurance coverage offers coverage for 2 or more persons with the fatality benefit payable at the death of the last of the insureds. Costs are considerably lower under joint life and survivor insurance policy than for policies that guarantee just one person, given that the likelihood of having to pay a fatality insurance claim is reduced.

Costs are significantly more than for policies that guarantee one individual, because the probability of having to pay a fatality insurance claim is greater. Endowment insurance attends to the repayment of the face total up to your beneficiary if death occurs within a specific duration of time such as twenty years, or, if at the end of the particular duration you are still alive, for the settlement of the face total up to you.

Juvenile insurance coverage gives a minimum of protection and might give protection, which may not be readily available at a later date. Amounts given under such coverage are typically restricted based upon the age of the youngster. The current restrictions for minors under the age of 14 (http://www.video-bookmark.com/bookmark/6186774/hsmb-advisory-llc/).5 would certainly see this page be the better of $50,000 or 50% of the quantity of life insurance policy in pressure upon the life of the candidate

What Does Hsmb Advisory Llc Mean?

Juvenile insurance might be offered with a payor benefit cyclist, which offers waiving future premiums on the youngster's policy in case of the fatality of the person that pays the premium. Senior life insurance policy, often referred to as rated survivor benefit plans, provides qualified older applicants with marginal whole life coverage without a clinical evaluation.

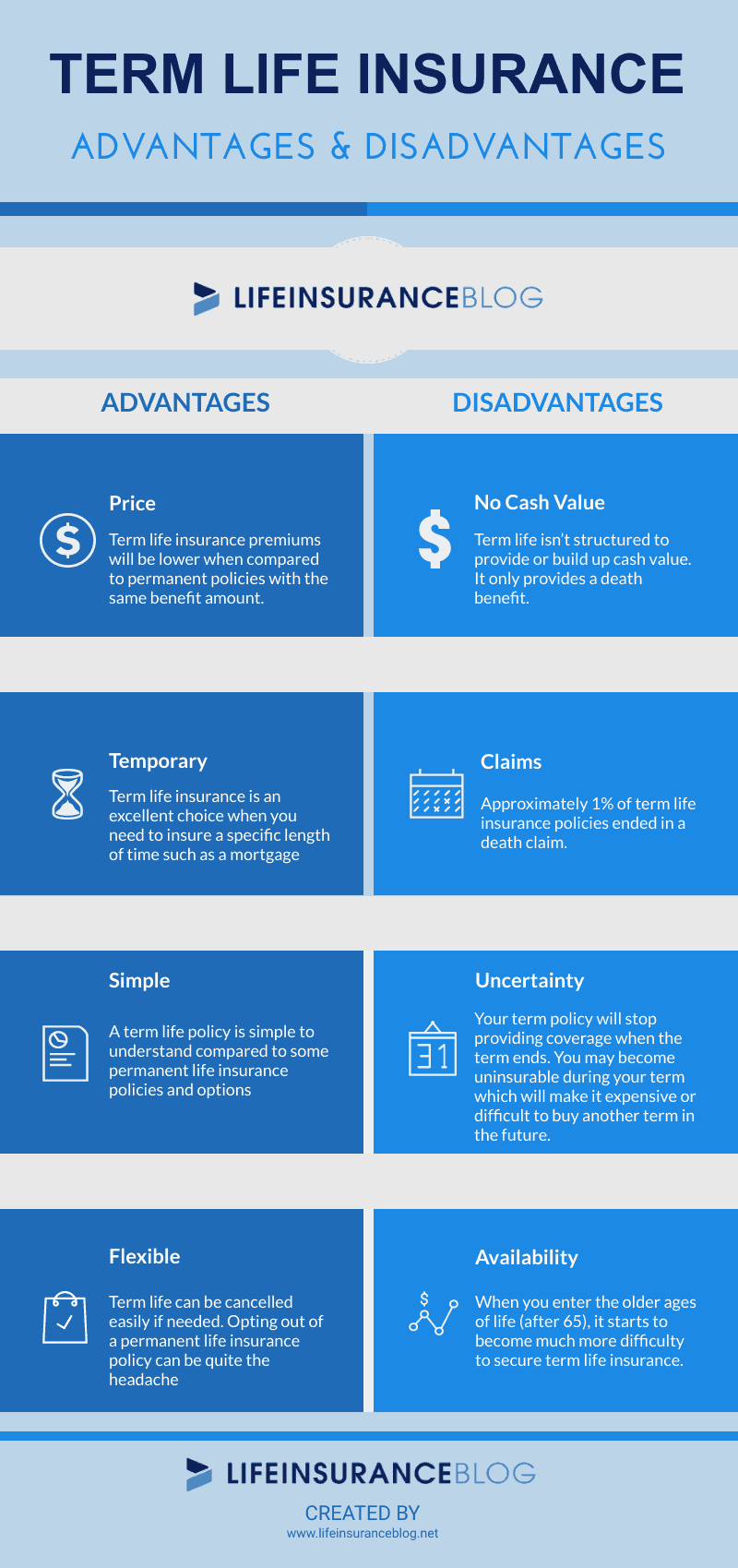

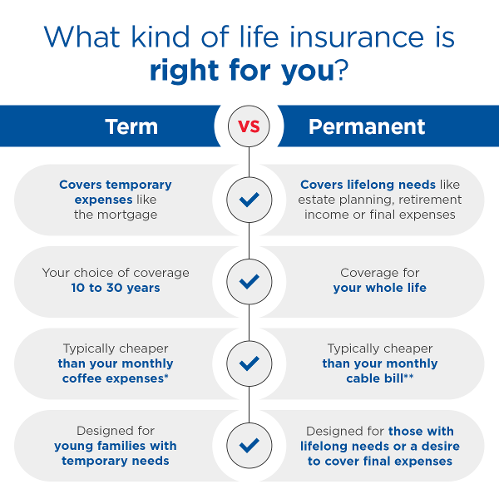

The objective of life insurance coverage is pretty basic: in the event of your fatality, life insurance policy will certainly offer insurance coverage for your household and enjoyed ones to ensure their economic safety and security. Life insurance policy benefits vary by plan type and each life insurance coverage strategy offers its very own collection of advantages for the policy owner.

Flexible term lengths that can be tailored based both on your family's requirements and spending plan. The option of converting to a Whole Life insurance policy plan. Lifestyle Insurance Coverage gives coverage that you can utilize throughout your life time. The advantages of Quality of Life Insurance include: Adaptable and economical term prices Lifestyle Insurance plan are not only cost effective given that they cover multiple needs, however they can likewise be gotten used to suit particular occasions in your life and permit you to access the cash benefit of your policy.

Not known Incorrect Statements About Hsmb Advisory Llc

You simply get the plan protection and maintain paying the same costs rate during your working and retired life years. The benefits of Whole Life Insurance coverage include: Adjustable insurance coverage that can be changed as your requirements transform.

For more details, go here. There are likewise some unanticipated benefits of life insurance coverage where your life insurance policy policy can cover situations and objectives you might not have actually taken into consideration. Health Insurance. Right here are a couple of unanticipated advantages of life insurance policy: If your partner is currently only responsible for your children, your life insurance plan can aid them spend for daycare or another childcare service while they go back to function.

The objective of life insurance is pretty simple: in the event of your death, life insurance policy will certainly give insurance coverage for your family members and enjoyed ones to guarantee their monetary safety. Nevertheless, life insurance coverage benefits vary by plan kind and each life insurance policy plan provides its own collection of benefits for the policy holder.

Getting The Hsmb Advisory Llc To Work

Versatile term lengths that can be personalized based both on your family's requirements and budget. The alternative of converting to a Whole Life insurance policy policy. Lifestyle Insurance Policy offers insurance coverage that you can use throughout your lifetime. The advantages of Lifestyle Insurance coverage consist of: Flexible and cost effective term rates Lifestyle Insurance plan are not only cost effective since they cover multiple requirements, yet they can additionally be gotten used to fit specific occasions in your life and permit you to access the cash benefit of your policy.

For even more info, click below. Insurance coverage for clinical expenses and costs. Whole Life Insurance Coverage has no protection expiration date it lasts your whole life. You merely get the plan protection and keep paying the same costs price throughout your working and retirement years. The benefits of Whole Life Insurance consist of: Flexible protection that can be changed as your needs transform.

There are likewise some unanticipated benefits of life insurance policy where your life insurance plan can cover scenarios and functions you might not have taken into consideration.: If your partner is currently solely accountable for your children, your life insurance plan could assist them pay for childcare or another child care solution while they return to work. Life Insurance St Petersburg, FL.

Report this page